What is Health Insurance?

Health insurance is a contract between a health insurance company and a health insurance member, where the member pays a premium in exchange for some or all of their health care costs to be covered by the health insurance company.

Types of Health Insurance:

Children’s Health Insurance Program (CHIP): A jointly funded state and federal program that provides health coverage to low-income children, and in some states, pregnant women in families who earn too much income to qualify for Medicaid but can’t afford private health insurance.

Group Health Insurance (Commercial Insurance): Health care coverage through an employer or other entity that pays for all eligible individuals in the group.

Health Insurance Marketplace (Exchange): A marketplace for individuals, families and small businesses to learn about health coverage options, compare costs and benefits for health insurance plans, choose a plan and enroll in coverage.

Medicaid/TennCare: A health insurance program for low-income families and children, pregnant women, the elderly, and people with disabilities. *Check out our Medicare and TennCare Eligibility page for more details.

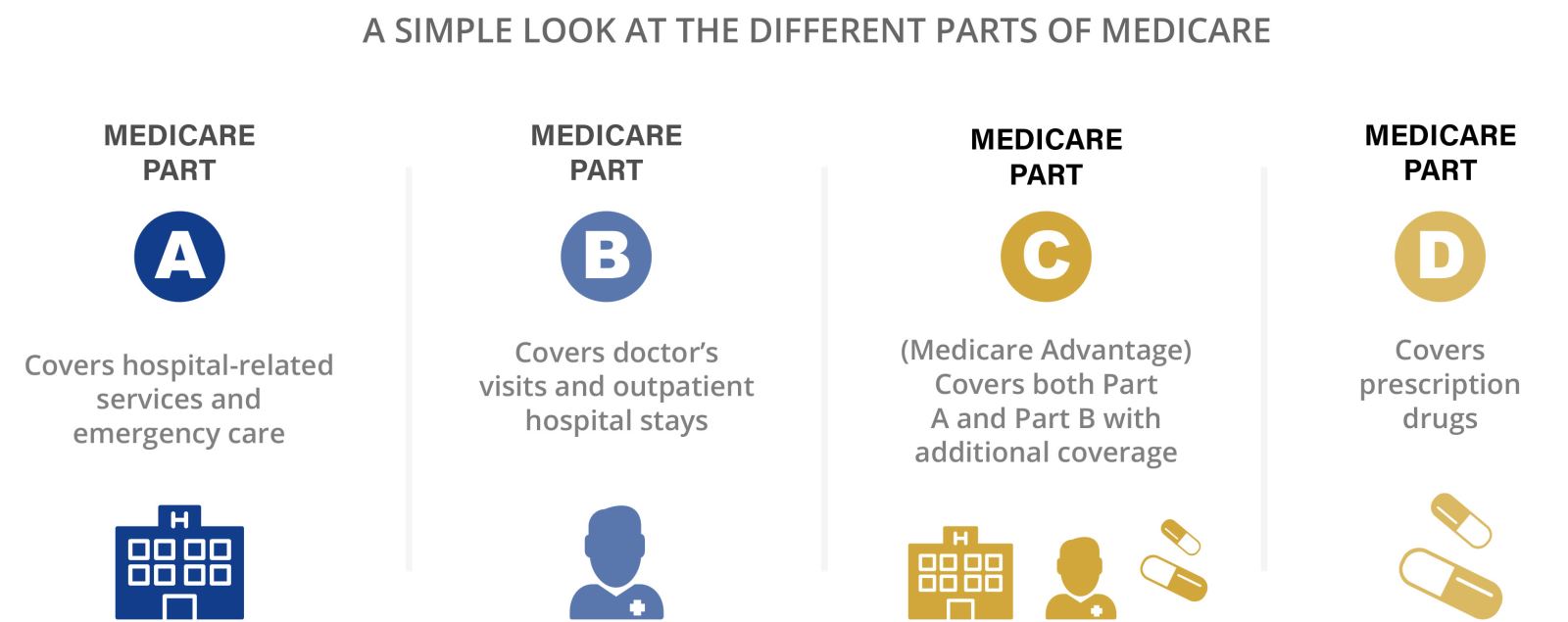

Medicare: A government health plan for people that are 65 and older, and certain younger people with disabilities. Traditional Medicare is accepted by most hospitals and physicians and will cover 80% of your health care costs. *Check out our Medicare and TennCare Eligibility page for more details.

- Medicare Part A (Hospital Insurance): Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B (Medical Insurance): Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Click here for details on the specific enrollment periods for Part A and Part B.

- Medicare Part C (Medicare Advantage Plans): A type of Medicare health plan offered by a private health insurance company that contracts with Medicare to provide you with Part A and Part B benefits. You may have to pay higher out-of-pocket costs if a provider is out of network with your Medicare Advantage plan. Open Enrollment for Medicare Advantage is October 15-December 7 each year. Click here for additional details.

- Medicare Part D (Prescription Drug Coverage): This program helps patients with Medicare to pay for prescription drugs. You can get Medicare Part D through a Medicare Prescription Drug Plan or a Medicare Advantage Plan that includes drug coverage.

- Medicare Supplement: A supplement is provided by a private insurer and helps to supplement the costs not covered by traditional Medicare. Since these plans are not contracted, you can go to any provider for care and be considered in network.

Types of Coverage:

Fee-for-service or Indemnity Plans: After a visit to your doctor, the insurance company will pay a percentage of the bill, typically 80%. The patient is then responsible for the coinsurance or remainder of the bill, which is 20% in most cases.

Managed Care: Plans that provide care at a lower cost, but are subject to certain rules that are put in place to lower the cost of care.

- Health Maintenance Organizations (HMOs): In an HMO, you receive care at a set fee and pay a small copay per office visit (about $10 – 25). These plans have a set list of in-network primary care physicians (PCP) that you may go to, who will then refer you to other specialists in the network, as needed.

- Preferred Provider Organization (PPOs): With a PPO plan, you can visit doctors that are in or out of network with your plan. However, if you see a doctor that’s out-of-network, you’ll be subject to pay more. A person with a PPO plan will pay a small copay and have a deductible that needs to be met before benefits are paid for by the insurance company. Once you’ve reached your deductible, you’ll start paying a predetermined coinsurance amount at each doctor’s visit.

- Point of Service (POS): With a POS, your in-network primary care physician (PCP) will refer you to other in-network specialists, as needed. However, you can also go to a doctor outside of your network without going through your PCP, at a higher cost to you.